Have you heard about the price of stainless? A year ago, I advised a customer, “Stainless is the new lumber.” At the time, the market for wood was sky high and headed north. People couldn’t build fast enough, couldn’t find material, couldn’t ship material, couldn’t harvest enough trees to keep us supplied with toilet paper, let alone pallets.

Have you heard about the price of stainless? A year ago, I advised a customer, “Stainless is the new lumber.” At the time, the market for wood was sky high and headed north. People couldn’t build fast enough, couldn’t find material, couldn’t ship material, couldn’t harvest enough trees to keep us supplied with toilet paper, let alone pallets.

Since then, you have noticed the price of gas has gone up. And you may have heard that used trucks are demanding a premium. And new trucks. And eggs. Milk. Homes. Taxes. Everything but wages.

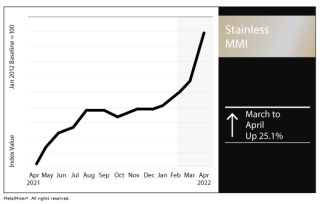

Stainless steel will not be outdone. March saw a 90% spike in nickel price, with an April increase of an additional 25% on its heels. Nickel is the added element that makes steel stainless. So if you watch nickel prices, you’re watching the stainless price.

Over the past four years, several mills have been able to reshore thanks to tariffs placed on steel and aluminum. Because of the manufacturing improvement, supply-chain disruptions were less severe than import-reliant industries. Although shipping was expensive due to fuel prices and crating charges, at least we could get flat sheet and tubing from maker to consumer.

Why are prices rising now? Russia is the leading exporter of nickel and nickel products. Nornickel alone accounts for about a quarter of the world’s supply, and they are widely sanctioned for geopolitical reasons. The invasion of Ukraine sent prices skyrocketing so quickly that some markets suspended trading for a week.

Eagle Mine is the only operating nickel mine in the United States. According to the Detroit News, it is set to close in 2025 when its treasures are expected to be exhausted. Nearby Cuba claims it stores one-third of all known nickel deposits but lacks the resources to get it out of the ground. Our other neighbor, Canada, has been a leader in production but miners there are facing the strictest environmental fines in history. Australia and Brazil have relatively large reserves, but how to get them through the congested ports of Los Angeles?

Eagle Mine is the only operating nickel mine in the United States. According to the Detroit News, it is set to close in 2025 when its treasures are expected to be exhausted. Nearby Cuba claims it stores one-third of all known nickel deposits but lacks the resources to get it out of the ground. Our other neighbor, Canada, has been a leader in production but miners there are facing the strictest environmental fines in history. Australia and Brazil have relatively large reserves, but how to get them through the congested ports of Los Angeles?

What’s the solution? Reducing use doesn’t seem to be an option, increasing recycling would help. Reshoring supply might work. Tesla’s influential CEO, Elon Musk, has characteristically set a lofty challenge before the industry: Mine more nickel. With some ingenuity, I predict we can come up with a cleaner – not perfect – process. It will take some compromise. Open air strip mines are not going to cut it, so more expensive underground mining will be required. Hardcore environmentalists will have to give a little, too, realizing nickel is essential to make batteries for electric vehicles.

In the end, supply will catch up with demand and prices will normalize.